Our Studies

Simplifying Digital Payments with Kansas

Kansas is a developing company in the digital payments and wallet industry dedicated to providing a consistent and secure transaction experience for its users.

Kansas is a developing company in the digital payments and wallet industry dedicated to providing a consistent and secure transaction experience for its users.

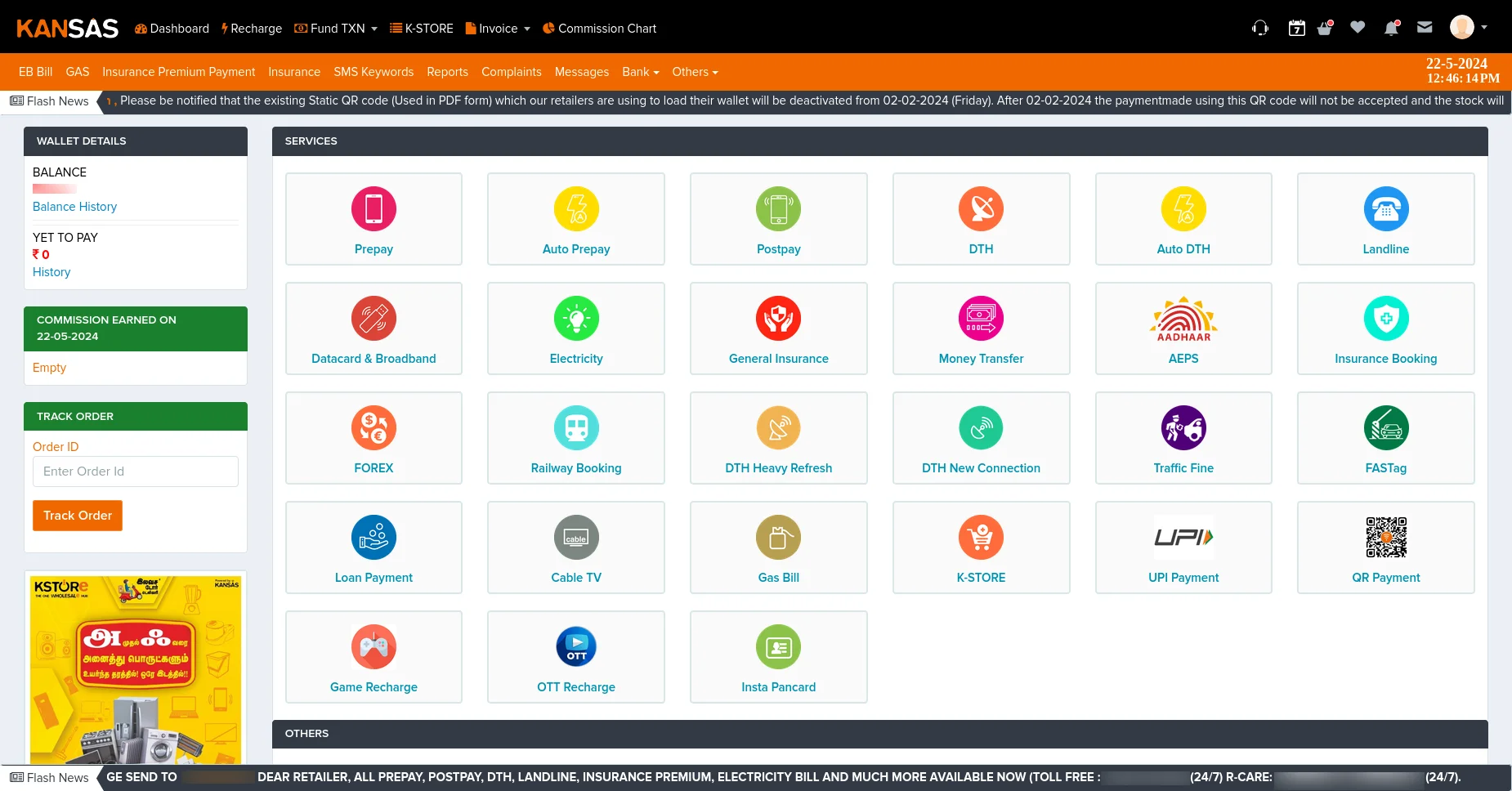

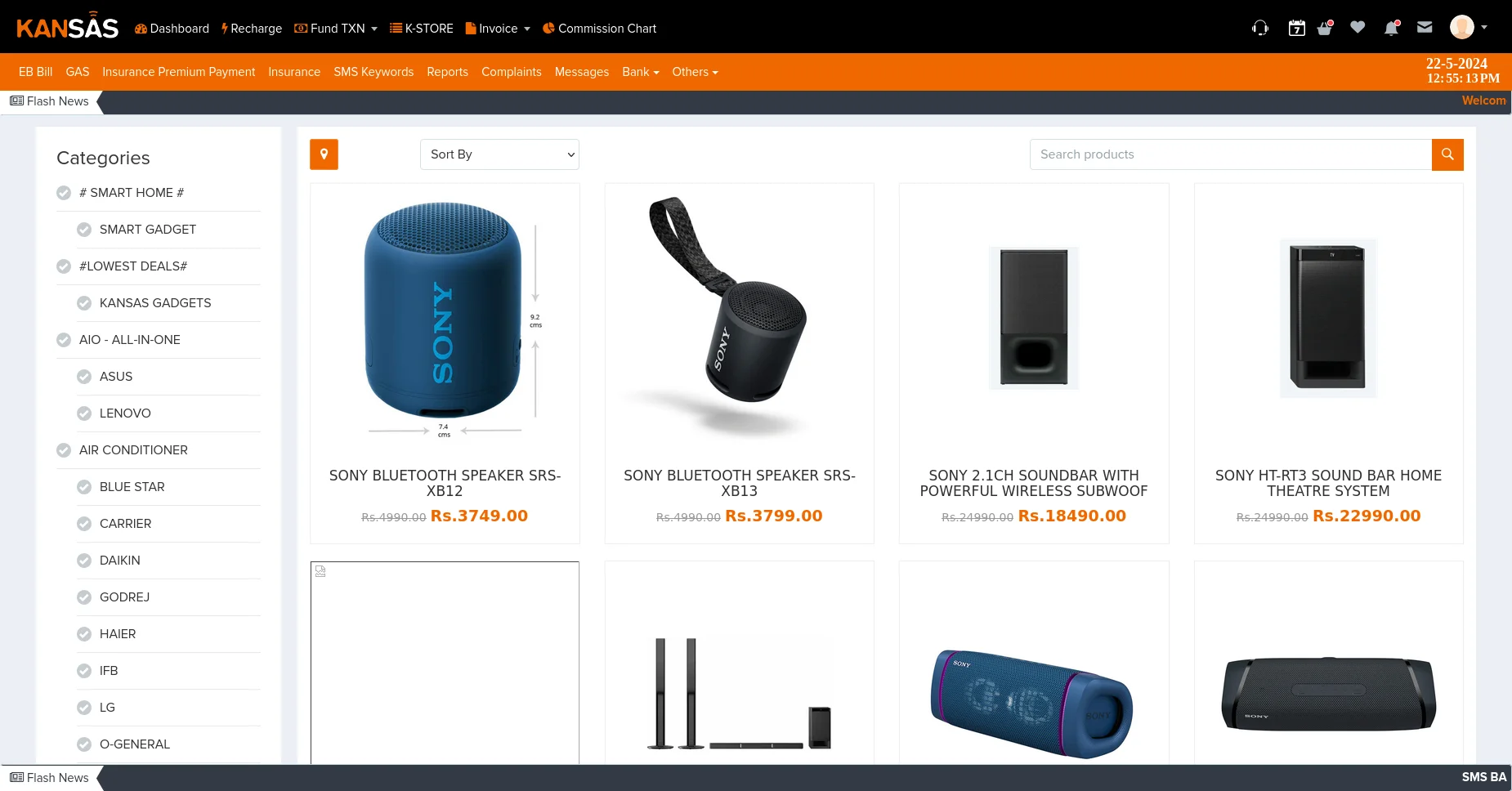

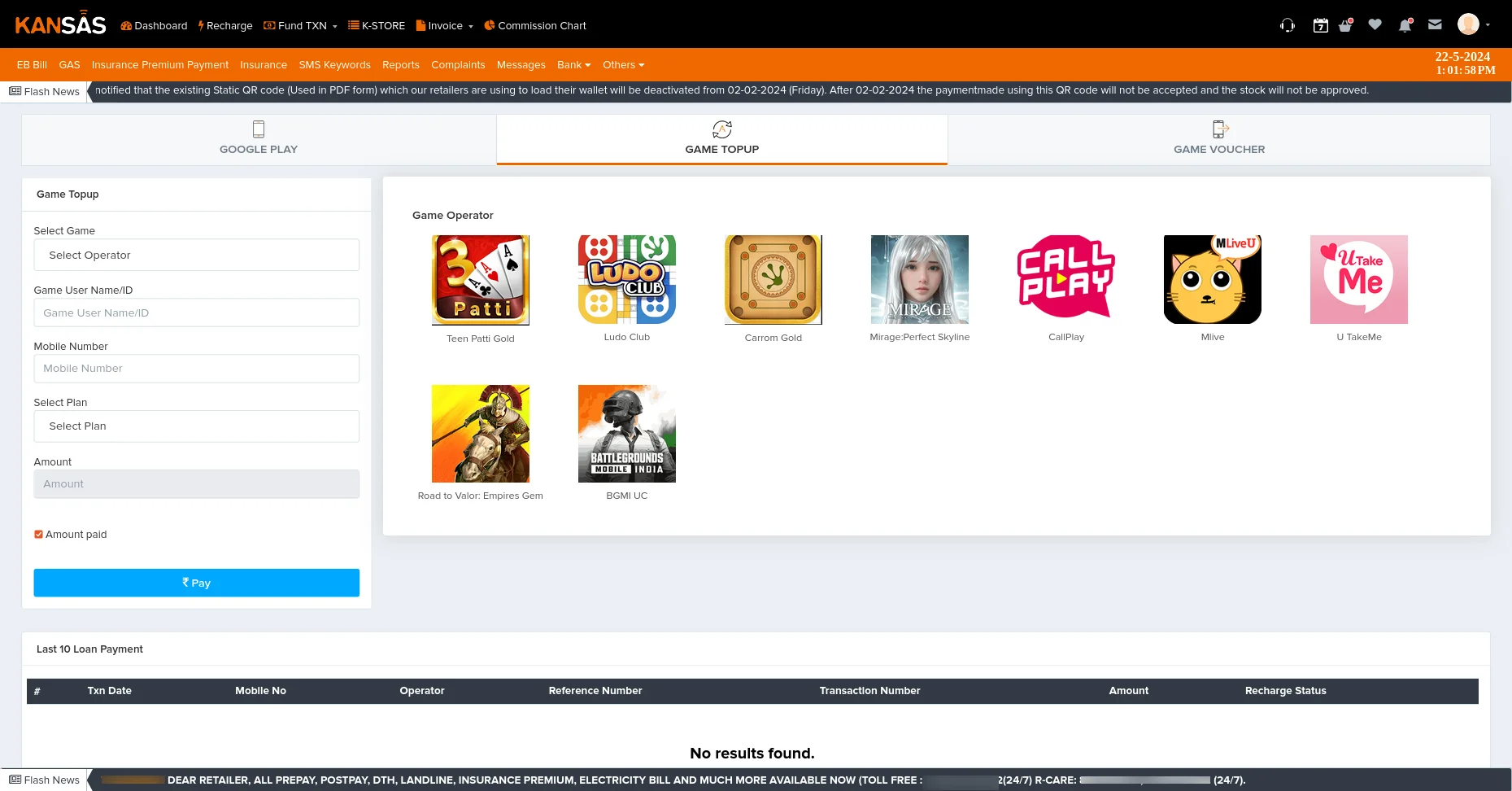

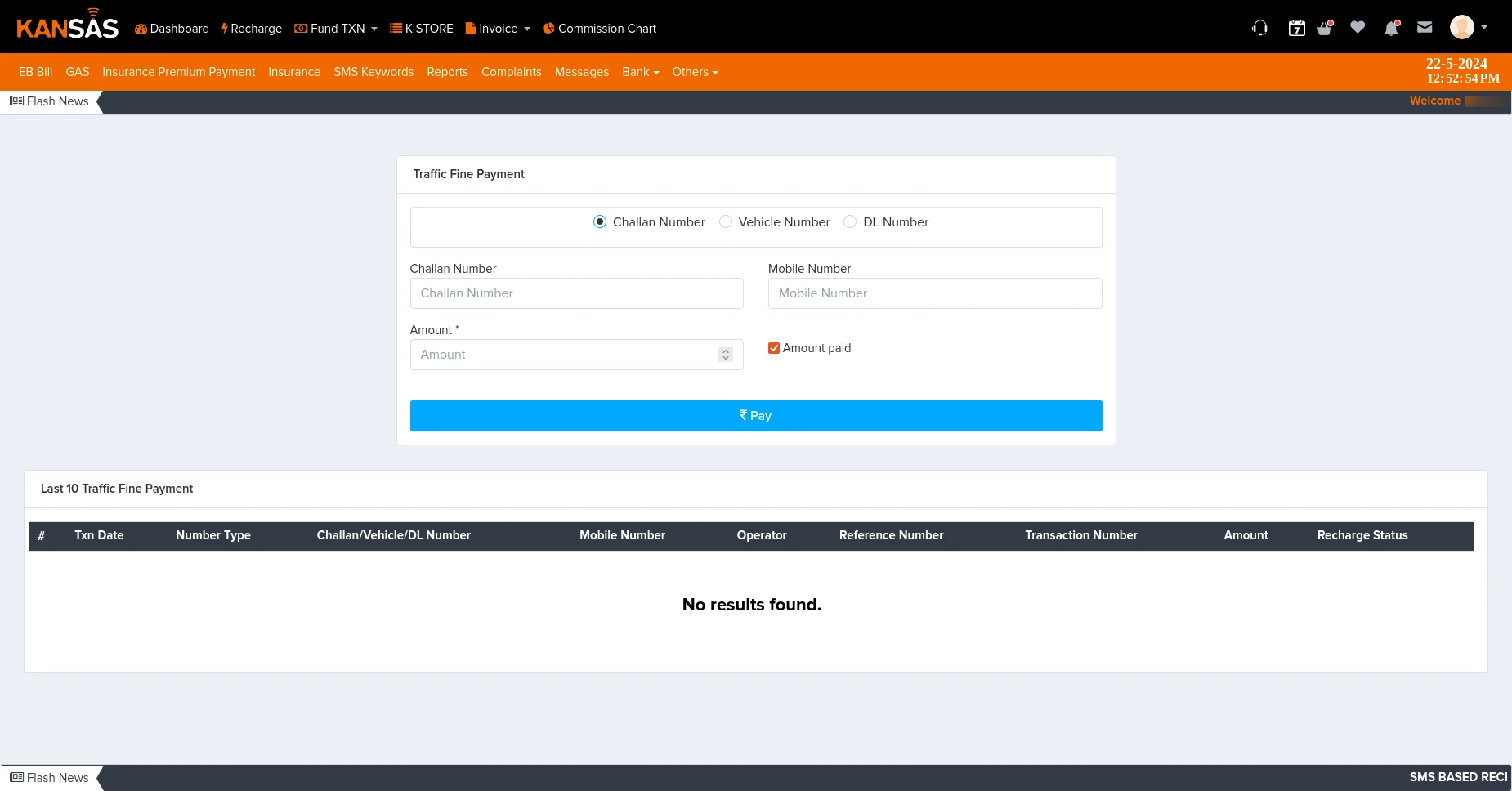

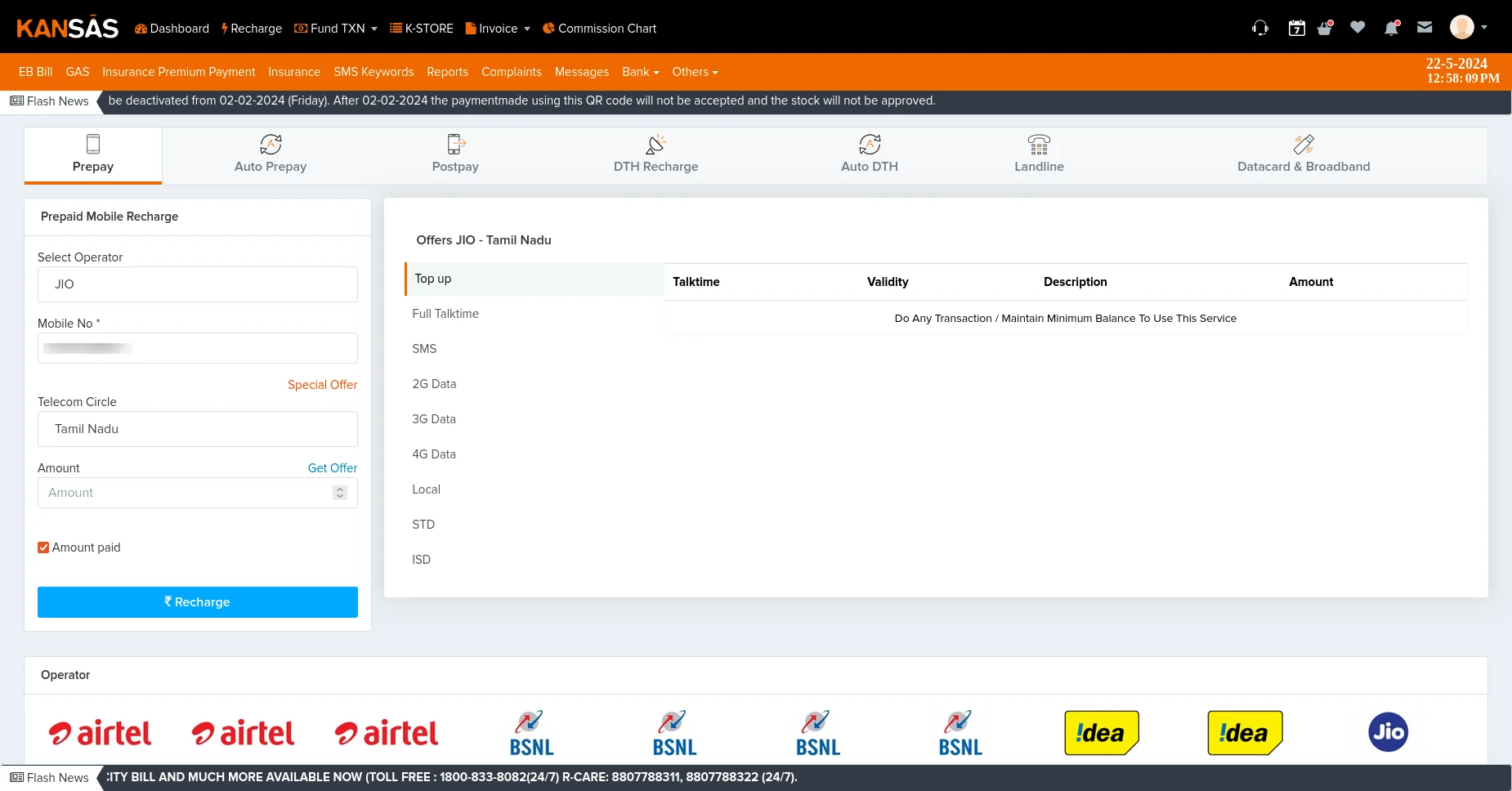

Kansas is a developing company in the digital payments and wallet industry dedicated to providing a consistent and secure transaction experience for its users. The platform offers a wide array of payment needs, including prepaid recharges, bill payments, money transfers, and more, all through a user-friendly web and mobile interface.

Kansas faced significant challenges in its existing payment processing system, including:

These issues underscored the need for an advanced, suitable application to enhance operational efficiency and user satisfaction.

Kansas adopted a cutting-edge microservices-integrated payment platform designed by Maestro to overcome these challenges. The solution includes:

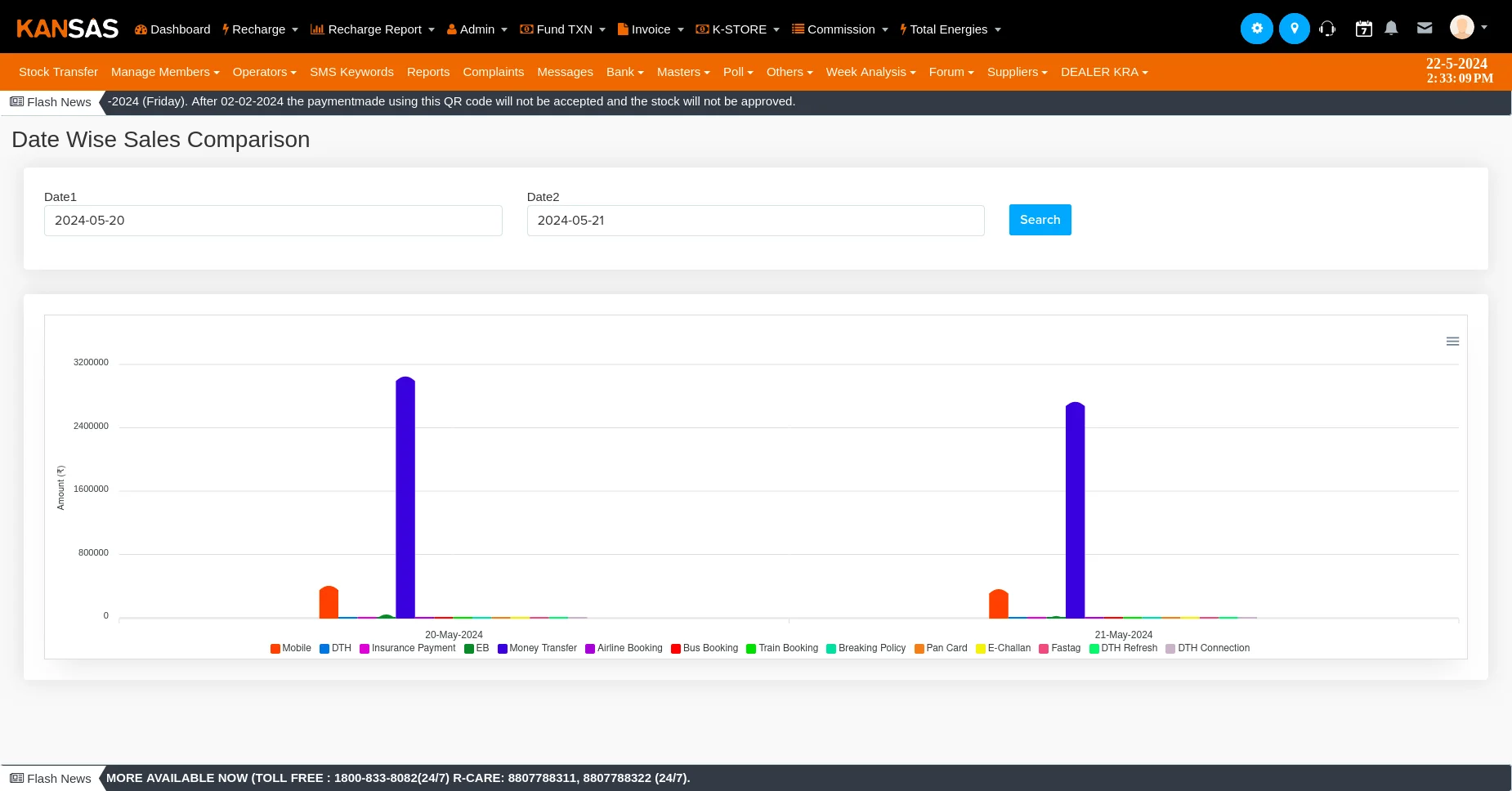

The deployment of the Kansas payment platform led to significant improvements:

Kansas leveraged technology to overcome payment processing challenges, indicating the impact of innovation on corporate success. This advanced payment platform not only simplified operations but also significantly boosted customer satisfaction and operational efficiency.

Kansas recommends similar businesses invest in microservices-integrated solutions to enhance their digital payment processes and customer engagement.