Kansas

Industry

Digital Payments and Wallet

Platform

Web and Mobile App

Country

India

Partnership Period

Oct 2016 to Present

Team Size

6 Experts

Overview

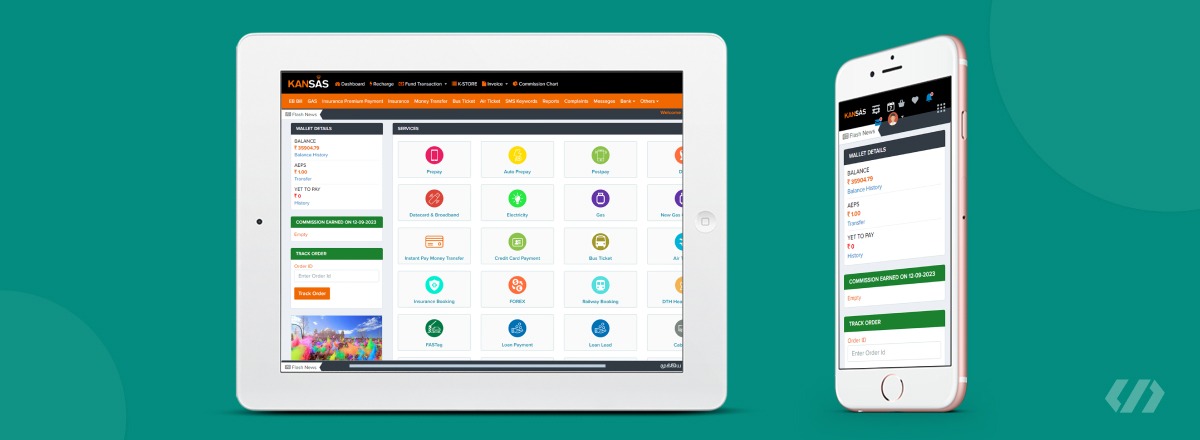

This use case describes the functionality and features of a micro services-integrated payment platform. The platform offers customers a user-friendly and efficient way to make secure transactions, manage rewards, and access various services. The system includes a web suite for admin management and a mobile app for users.

Key Stakeholders involved

- Kansas Founder

- Project Manager

- Developers

- Designers

- Testers

- Customers (end users)

- Admin and support staff

- Channel partners and dealers

- Developers and technical team

Preconditions

- Customers must have access to a device with internet connectivity.

- Admin and support staff must have valid credentials to access the web suite.

Main Flow

- Customers access the mobile app or web suite.

- Customers initiate transactions for prepaid recharge, DTH recharge, data card recharge, electricity bill payments, money transfer, travel bookings, and insurance premium payments.

- The micro services architecture processes transactions, ensuring each transaction is completed within 10 seconds.

- Transactions are encrypted to ensure secure communication and protection of sensitive data.

- Admin accesses the web suite to manage access and permissions, user logins, transaction processes, reward points, and more

- Admin monitors and oversees the platform’s functionality and user activities.

- Channel partners and dealers utilize the multi-recharge feature to facilitate prepaid services.

- Users can also use Aadhar-enabled payment for added convenience

- Franchise management features allow for effective coordination and support.

Alternative Flows

- If a transaction cannot be completed within 10 seconds due to technical issues, users are informed about the delay.

- If there are issues with encryption, the transaction is rejected, and users are notified to retry.

Technology used

- Micro services architecture for quick and efficient transaction processing

- Encryption algorithms for data security

- Web suite for admin management

- Mobile app built in React Native for Android and iOS platforms

Post Conditions

- Completed transactions are reflected in users’ accounts.

- Admin updates and changes are applied to the platform.

Business Impact

- The platform offers fast, secure, and user-friendly payment services, enhancing customer satisfaction.

- Channel partners and dealers benefit from streamlined recharge processes.

- Admin web suite improves management efficiency.

Related Use Cases

- User Reward Points (commission amount credited into Kansas wallet) based on the services used

- Channel Partner Recharge Management

Assumptions

- Users have basic familiarity with mobile apps and web interfaces.

- Customers have valid payment methods linked to their accounts.

Future Considerations

- Continued updates and enhancements to the mobile app and web suite

- Integration with emerging payment technologies and services.

This use case outlines the core functionality of the micro services-integrated payment platform, emphasizing its secure and quick transaction processing, admin management, and support for various payment services. It also highlights the ongoing commitment to updates and enhancements to meet evolving user needs and technological advancements.