KTM Jewellery

Industry

Retail

Platform

Web and Mobile App

Country

India

Partnership Period

Jan 2022 to Present

Team Size

4 Experts

Overview

KTM Jewellery aims to digitize their gold chit schemes, allowing customers to subscribe, make payments, and manage details through a customer mobile app. Collection agents use an employee app to collect payments , while an admin portal manages schemes, payments, and collection reports.

Key Stakeholders involved

- Customers: Subscribes to chit schemes, makes payments, and manages details through the customer mobile app.

- Collection Agents: Uses the employee mobile app to collect payments and create new customers with subscribing to new schemes.

- Admins: Manage chit schemes, customer data, payments, and collection report through the admin web portal.

Preconditions

- The custom-built applications (customer app, employee app, admin portal) are developed and operational.

- Mobile apps are available on the respective app stores.

- Employees are trained on using the employee app.

- Admins have access to the admin web portal.

Main Flow

Customer Mobile App:

- Customer installs the mobile app and creates an account or logs in.

- Customer views available chit schemes, selects desired plans, and subscribes to them.

- Customer can request for the product demo from the nearest branch.

- Customer views upcoming payments, due dates, and outstanding amounts.

- Customer makes payments using preferred payment methods (online banking, cards, UPI).

- Customer receives payment confirmation in the app.

Employee Mobile App:

- Collection agent logs into the employee app.

- Agent views the list of customers due for payments and schedules visits.

- Agent visits customers, collects cash payments, and updates payment details in the app.

- Agents can create new customers with subscribing to new schemes

- Agent enters OTP sent to the customer’s mobile number to verify payment.

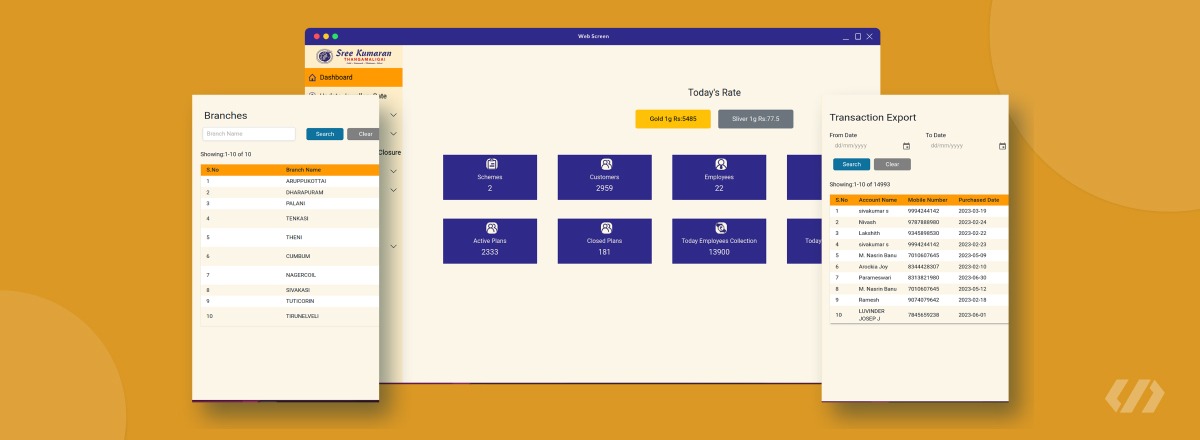

Admin Web Portal:

- Admin logs into the web portal with authorized credentials.

- Admin manages chit scheme details, creates new schemes, and updates existing ones.

- Admin views and manages customer data, including subscriptions, payments, and contact information.

- Admin monitors chit scheme payment statuses and scheme closure status.

- Admin can preclose the customer schemes.

- Admin can manage the customer product demo requests.

- Admin views and analyzes collection data for efficiency.

Alternative Flows

- If a customer faces technical issues with the app, they can opt for manual payment at the jewelry store.

- If a collection agent’s app malfunctions during payment collection, they record the payment manually and report the issue.

Technology used

- React, React Native, Python, MySQL , Nginx

Post Conditions

- Customer payments are recorded and updated in the system.

- Admin monitors chit scheme statuses and collection agent activities.

Business Impact

- Enhanced Customer Convenience: Customers can easily subscribe to and manage chit schemes from the comfort of their homes.

- Efficient Payment Collection: Collection agents can securely collect payments, reducing the need for customers to visit stores./li>

- Improved Data Management: Admins can monitor chit scheme statuses, customer payments, and agent efficiency in real-time.

- Customer Engagement: The customer app facilitates engagement through notifications and updates about chit schemes.

- Data-Driven Insights: Data collected from the apps and web portal can provide insights for better decision-making.

Related Use Cases

- Payment Gateway Integration: The system integrates with secure payment gateways to facilitate online payments.

- Customer Support: A support is in place to assist customers with app-related issues.

- Scheme Closure Process: Application manages the process of closing chit schemes when they reach completion.

Assumptions

- Customers have access to smartphones and the internet.

- Collection agents have smartphones with the employee app installed.

- Payment methods available in the customer app are secure and reliable.

- Customers receive OTP verification for payment authentication.

- The web application can handle the required scale of data management.

Future Considerations

- Enhanced Analytics: Incorporate advanced analytics to provide insights into customer behavior, scheme performance, and agent efficiency.

- Biometric Authentication: Explore adding biometric authentication for enhanced security during OTP verification.

- Integration with CRM: Integrate customer relationship management (CRM) tools to enhance customer engagement.

- Automated Notifications: Implement notifications for upcoming payments, scheme updates, and successful payments.

- Expansion to Web: Develop a web version of the customer app for users who prefer desktop access.